Accounting isn't everyone's favorite task, especially around the end of the month. But the fact remains that end of Month accounting routines help ensure that mistakes are caught and corrected so that you have an accurate picture of your business's finances.

By following a regular, documented routine each month, you won't let anything slip through the cracks and you will demonstrate to the company's auditors that you've followed the correct accounting procedures.

It's also a best practice to set realistic timelines between the accounting team and management, after all, you are providing information that will ultimately be used to make business decisions.

Keeping a good routine allows you to catch the following:

-

- overpayments

- bank errors

- incorrect customer payments

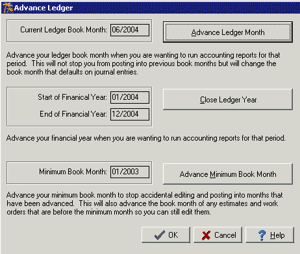

Windward has you covered with end of month routines that will save time

|

|

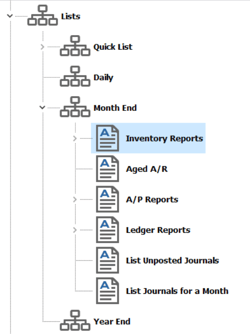

Stay Organized with Month-End Lists:Some recommended reports to run on a monthly basis for retention:

|

|

Where to find more info:

|

Next week's webinar will cover this topic: |

NEW: Windward Wiki Article with streamlined End Of Month Procedures and recommended reports. Windward Wiki End of Month Procedures Courses in the Windward Learning Academy |

Professional Services are Available for Advanced Training

Get the most out of your ERP withCall your account manager if you would like to enroll in the Month/Year end Best Practices service from our Professional Services Catalog. |