Standard and Customized Reporting Capability

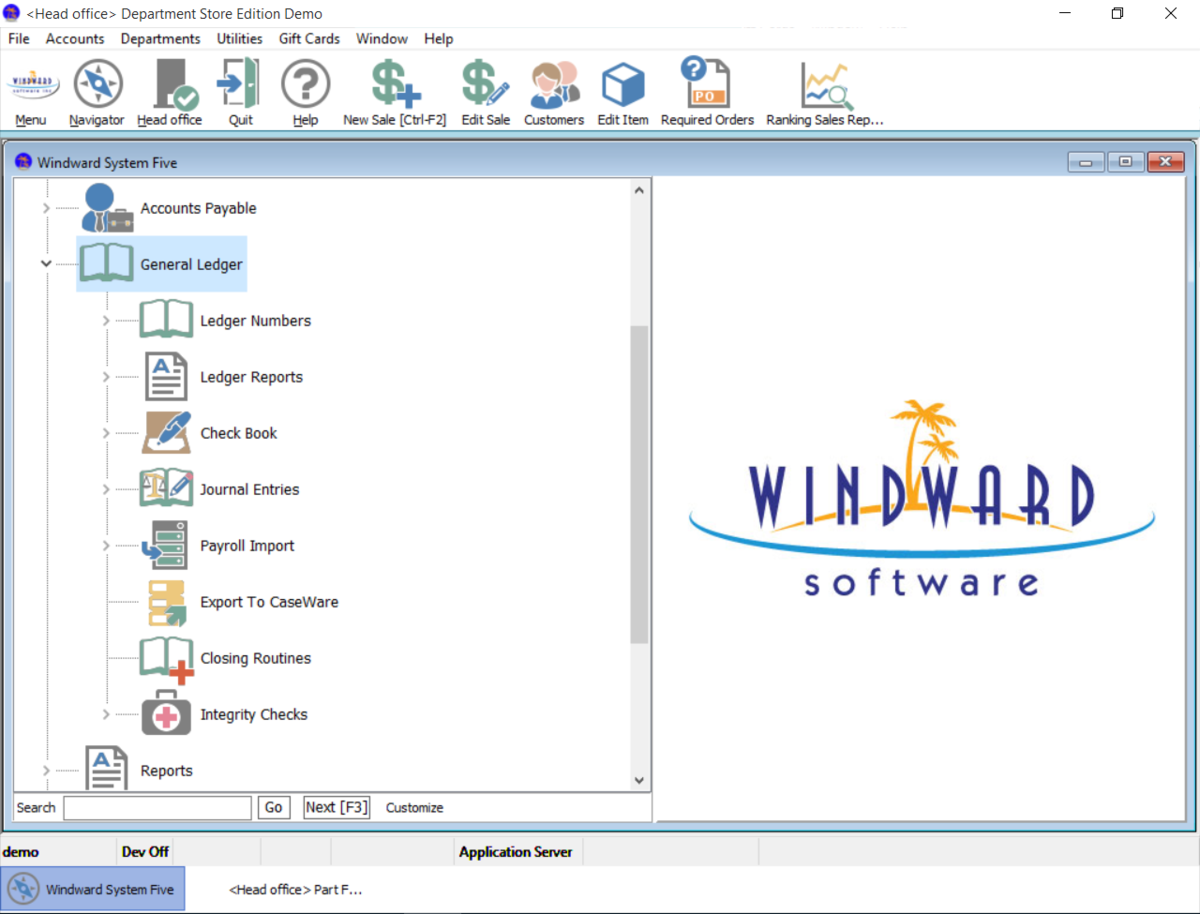

Windward’s accounting software comes with several pre-built ledger reports such as balance sheets, income and expense statements and other commonly used documents. It also comes with its own ledger report writer, so you can build your own reports for comparing income this year to last year and the year before, or income to budget. You can also report on different areas of your business, such as the service side from the parts sales side.

The Ledger Reports menu gives you access to reports that collect and summarize system data from a general ledger perspective. And if you need to integrate with CaseWare, our accounting software supports that too.

View Reports the Way You Want

With Windard, you can view, print or export balance vs budget amounts. You can also show a table of the account balances, with the months in the left column and the years on the top row. The balances tab displays the current accounts balance in the selected currency in a month-by-month view. Another option is to use a graphical view of the account showing the amount, month and year. You can even customize the graphs that appear in the chart tab.

Our accounting software allows you to show the account number, description, as well as the maximum and minimum amounts allowed in the account.

- Eliminates the need for batch processing

- Generate P&L statements and other financial reports

- Supports recurring entries to save time

- Store and access historical data

- Simplified journal entries

- Fully integrated with other modules

- Detailed records in the event of an audit

- Recommended by accountants

Integrated Accounting Package

Windward Software's business accounting software is fully integrated. That is, when you create an invoice, the general ledger is updated immediately so you don’t have to run a batch process at a later point.

Windward’s accounting software integrates seamlessly with our other System Five modules:

- Inventory control

- Sales

- Order entry

- Marketing

- Purchasing

- E-commerce

- Point of sale

- Shipping & receiving

Batch processing represents the old way of handling ledger transactions, and it had many flaws. Most notably, separate procedures are required to post invoices, payments, bills and checks into the general ledger. This increases the likelihood of something going wrong. More importantly, a batch total is posted, making it very difficult to reconcile the accounts at a later date. We’ve witnessed many examples of tax auditors spending days, and even weeks, looking through paper batch reports, and nobody wants the tax police hanging around.

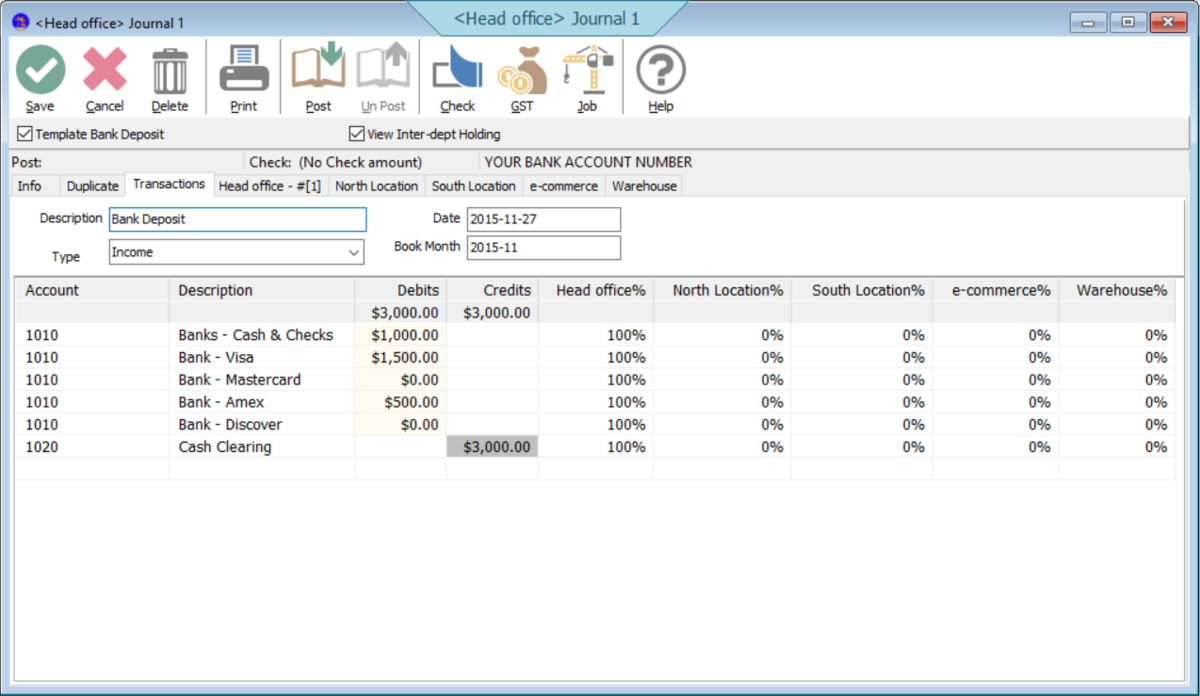

Journal Entries

When journal entries are required, they’re simple and easy to perform and are based on standard double entries where the debits must equal the credits. However, if you've made a large entry and it doesn't balance, Windward's accounting software allows you to save it without posting, so you can return to finish it later.

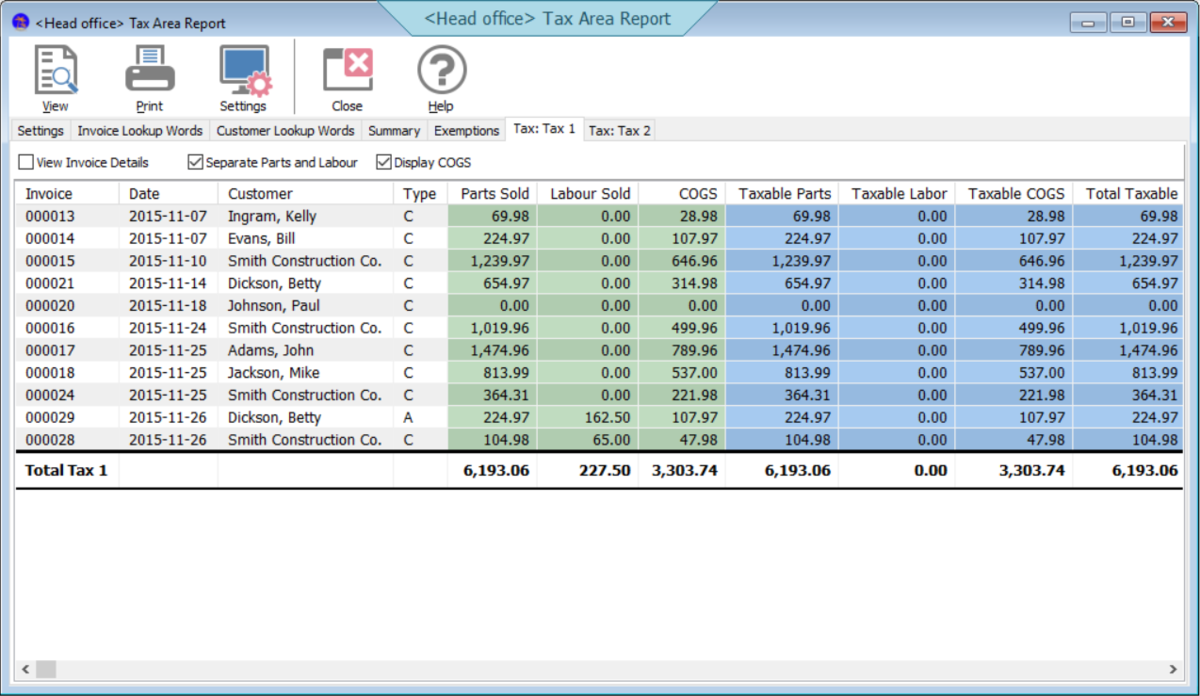

Detailed Ledger Entries

With Windward accounting software, each line you see on an invoice is stored as its own record in the database. When viewing the general ledger, the system views the same lines, but from a different point of view, and on a different index. The result is simplicity, which reduces the chance of there being a problem. If you do need to edit an invoice, the ledger is also fixed simultaneously because it's the same record. This reduces errors, saves time and it also saves a huge amount of space required for hard drives and backup storage.

And then, when the sales tax police do arrive, they can view the ledger details, and for each line, they’ll have all the information they need at their fingertips: date, invoice number, customer name and amount of sales tax collected. It’s fast, simple and error-free.

Work in Multiple Months Simultaneously

How long does it take to perform a month end with your current business accounting software? How about a year end? Typically, it takes a few weeks for the bills and bank statements to arrive in the mail, so a month end is generally not completed until the middle of the following month.

With a year end, once you’ve entered all of your information, you must pass on the reports to your accountant so they can work their magic: depreciation, tax calculations and forms to be filled out so it can all be submitted to the government. By the time you're done, it could be six months.

Believe it or not, most competing business accounting software systems don’t properly allow you to report on your business for past months or years. Some might allow you to enter the data, but when it comes to reprinting an accurate set of financial statements for a given point in history, most come up short.

Reprint Historical Reports

With Windward Software, you can reprint an income and expense statement for any month, in any year, at any time. The same goes for:

- Balance sheets

- Aged accounts receivable reports

- Aged payables reports

This is not trivial. When you reprint an aged payables report for the previous month, the system ignores bills and checks entered in the current month showing the true condition for the end of the previous month.

What this means to you is that you can stay on top of your current workload and still generate the historical reports you need. We have witnessed many people using other business accounting software packages pile up the work on the corner of their desk until they are finished with a month end, and then scramble to catch up.

Recurring Entries

Some entries recur regularly. Not only are many of them time consuming, but they’re also complex. Consider, for example, monthly salary payments or lease installments. It’s easy to make an error when working on either one. Cutting and pasting would be very useful, but System Five isn’t a word processor. Instead, we have enabled recurring entries to simplify the process.

Windward System Five accounting software allows you to copy recurring entries into future months so that you don't have to post the same entry over and over, or possibly forget to post an entry. You can post forward into any month of the year, and even into the following year.

This can be useful when buying business insurance, for example. Let's say you make a lump payment of $1,200 for your yearly coverage in July. Is this really a July expense for $1,200, or are you in fact spending $100 per month and just happened to have paid the entire bill in July? From an accounting point of view, it's best to expense a little of this each month so that you can accurately gauge how much it costs to run your business monthly.

To do this, you would post the $1,200 to prepaid expenses as an asset (something you own that is of value to the company), and then transfer $100 from prepaid expenses and post it to insurance expense each month. With Windward, you can use our accounting software to create the entry for one month and then copy it to the other 11 months, saving you time and effort.

Check (Cheque) Writing

Normally, you’ll enter your bills and checks into the accounts payable system, but for one-off checks for a vendor you’ll likely never deal with again, that is a lot of work. Windward System Five allows you to create and print checks directly from the journal entry in one simple step. Windward can print to any kind of check, so you don't need to buy new ones. Just use the form designer to set them up.

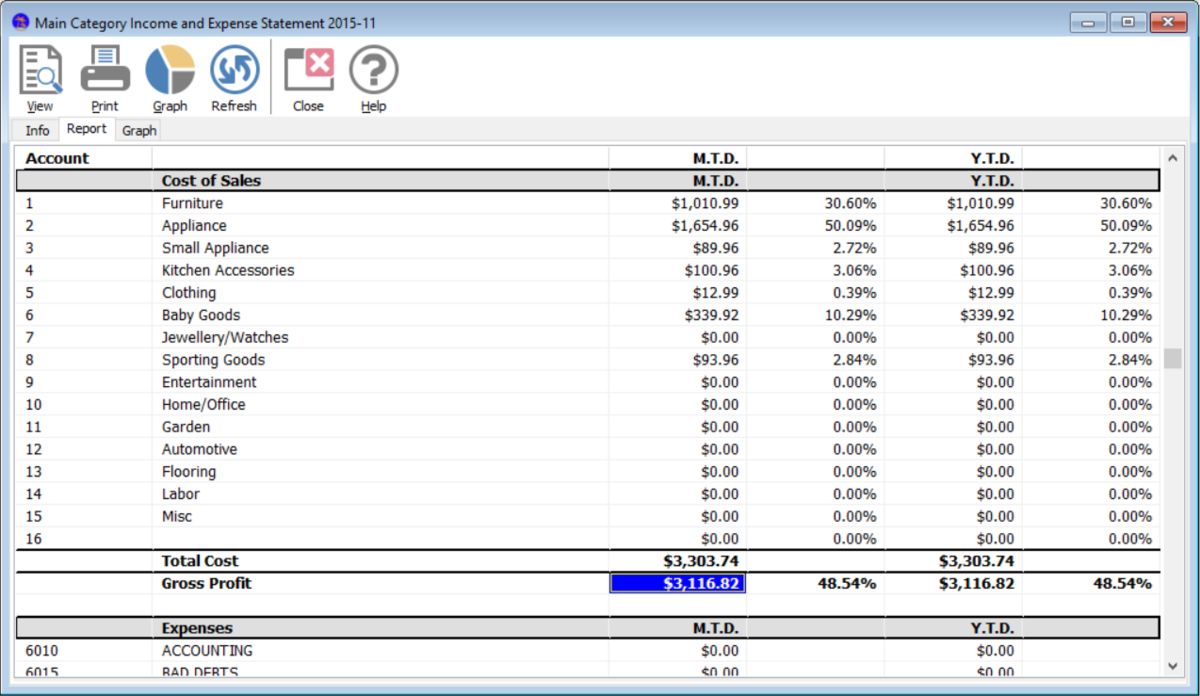

Profits and Loss Statements

A profit and loss (P&L) statement is also known as an income and expense report. It shows how well a company buys and sells inventory (or services) to make a profit. A firm must create a profit in order to survive and remain solvent. Careful analysis of the components of a P&L is important in determining the cash flow available to:

- Repay existing debt

- Finance additional debt (for business expansion)

- Reinvest in the company

A P&L statement details the amount of income and expense for each ledger number, presenting the data for the current month, while also providing a year-to-date total. Using the ledger report writer in Windward’s accounting software, you can build your own reports to compare this year to last and the year previous, and compile other reports important to your business.

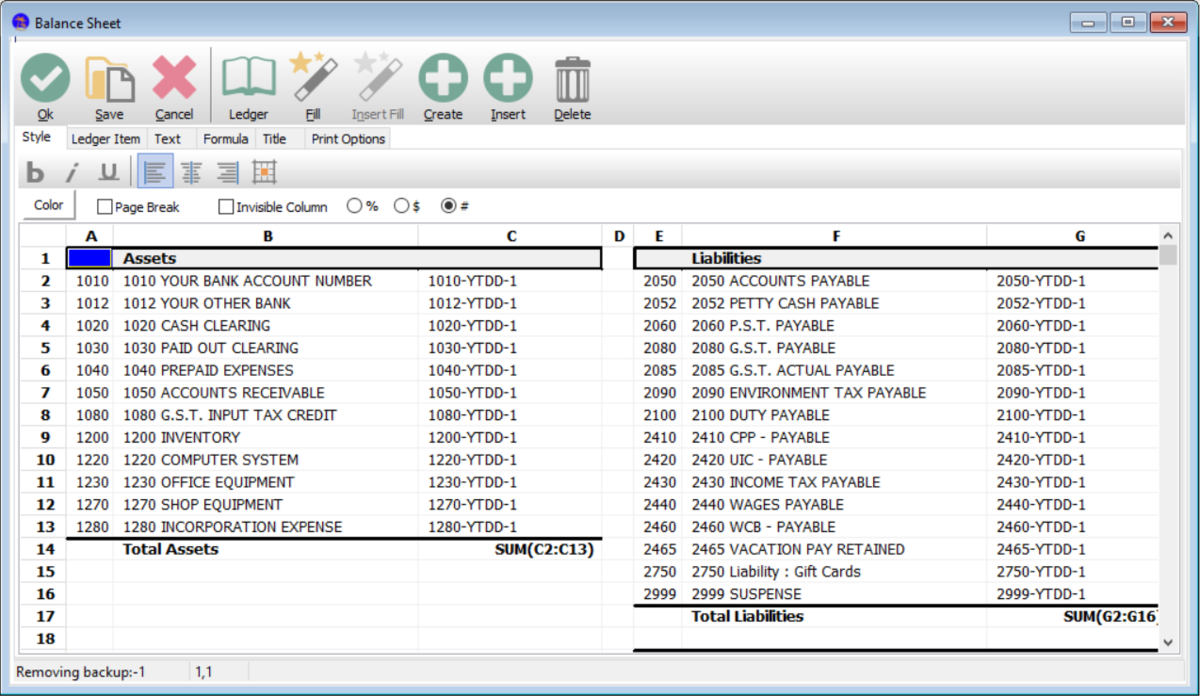

Balance Sheets

A balance sheet is a snapshot of a business’s financial condition at a specific moment in time, usually at the close of an accounting period. It comprises:

- Assets

- Liabilities

- Owners’ equity

- Stockholders’ equity

Assets and liabilities are divided into short- and long-term obligations including cash accounts such as checking, money market or government securities. At any given time, assets must equal liabilities, plus owners’ equity. An asset is anything the business owns that has monetary value. Liabilities are the claims of creditors against the assets of the business.

As the name suggests, the balance sheet must balance. In other words, the assets must equal the claims on assets. The concept of balancing relies on the accounting equation: Assets = Liabilities + Owner’s Equity (capital)

There are a lot of tricks to reading a balance sheet properly, which we won't get into here, but it's good to know that you can go about your business with the peace of mind that our accounting software automatically keeps this important document up to date.

40-year Account History

Windward System Five keeps track of your business for the current year, previous year and many years previous to that. Not only is it an important safeguard to keep this information readily accessible, it allows you to compare how your business is performing this year to other years. Every invoice and transaction created is stored in its original form with all its detail. For example, you could easily pull up a customer's past invoice for warranty purposes, and even reprint it if required.

Windward's philosophy has always been to store the data as it was entered, so that reports could be created in the future that may not have been thought about when we originally created our accounting software. Over the years, this has been a big benefit to Windward users as they’ve been able to run newly created reports comparing their historical data to the current year.

We know you don't need 40 years of history, but many programs erase your data after your year end. Some generously give you an extra month (13th month) to clean up your year end before purging your data. With Windward accounting software, YOU get to decide when you no longer need the data. Many products are now sold with 10-year warranties, or longer (i.e. roofing shingles), so we humbly suggest that you keep your data online for at least 10 years.